Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. ➡️Webcasts – Moreover, the broker offers live updates on markets and trading tactics, such as technical analysis and options strategies. In 1971, when it was established, TD Ameritrade was a full-term broker in discount packaging. However, it has evolved over the years to build its brand as a high-ranking broker. As a long-time user of both the desktop and web versions of thinkorswim, I can attest to the fact that it was a true leap in innovation for the industry when first released.

Step 6: Monitoring and Managing Your Positions

TD Ameritrade offers several methods for depositing funds, including wire transfer, check deposit, and electronic funding methods like ACH. It’s important to note that TD Ameritrade has a minimum deposit requirement, so ensure you meet this requirement before proceeding. No, forex trading on TD Ameritrade involves a high level of risk and is not suitable for all investors. It is important to educate yourself and understand the risks involved before trading forex.

Popular stock broker reviews

In this step-by-step guide, we will walk you through the process of trading forex on TD Ameritrade, highlighting the key features and tools available to help you make informed trading decisions. After funding your account, it is crucial to familiarize yourself with the trading platform provided by TD Ameritrade. The platform offers a range of tools and features to help you analyze the forex market and execute trades.

TD Ameritrade Trading Platforms and Software

In conclusion, trading forex on TD Ameritrade can be a rewarding experience if approached with the right knowledge and tools. Remember that forex trading requires continuous learning and practice, so it is important to stay updated with market news and trends while refining your trading skills. Forex trading, also known as foreign exchange trading, has become increasingly popular in recent years. With its potential for high profits and accessibility to retail traders, it has attracted a significant number of individuals looking to enter the financial markets.

Popular Forex Broker Reviews

Once your account is funded, download the thinkorswim platform and take some time to explore its features. TD Ameritrade also provides educational resources and tutorials https://forexbroker-listing.com/ to help you understand the platform better. Before executing any trades, it is essential to conduct thorough research and analysis of the forex market.

- ➡️Talking Green Podcast – This podcast provides talks and ideas on personal finance and investment themes to assist listeners in making educated financial decisions.

- Traders should have backup plans in place and use reliable trading platforms that offer robust technical support.

- Forex trading has gained immense popularity in recent years, thanks to its potential for high returns and the accessibility it offers to traders of all levels.

Use different technical indicators to support your trading strategies and optimise your entry and exit points. One of Thinkorswim’s standout features is its array of idea generation tools and comprehensive research offerings. Traders can leverage these resources to stay ahead of ameritrade forex broker market trends and make data-driven decisions. Active traders, passive investors, and hands-off investors can all benefit from TD Ameritrade and Merrill Edge’s offerings. But TD Ameritrade is better for those who want to expose their portfolios to assets like forex and IPOs.

An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content. TD Ameritrade’s liquidation policy for forex trades is once daily for any account with a level of risk less than 100% when observed at 4 a.m. Solead is the Best Blog & Magazine WordPress Theme with tons of customizations and demos ready to import, illo inventore veritatis et quasi architecto. Non-profit organizations and investors looking to open limited liability or partnership accounts prefer TD Ameritrade.

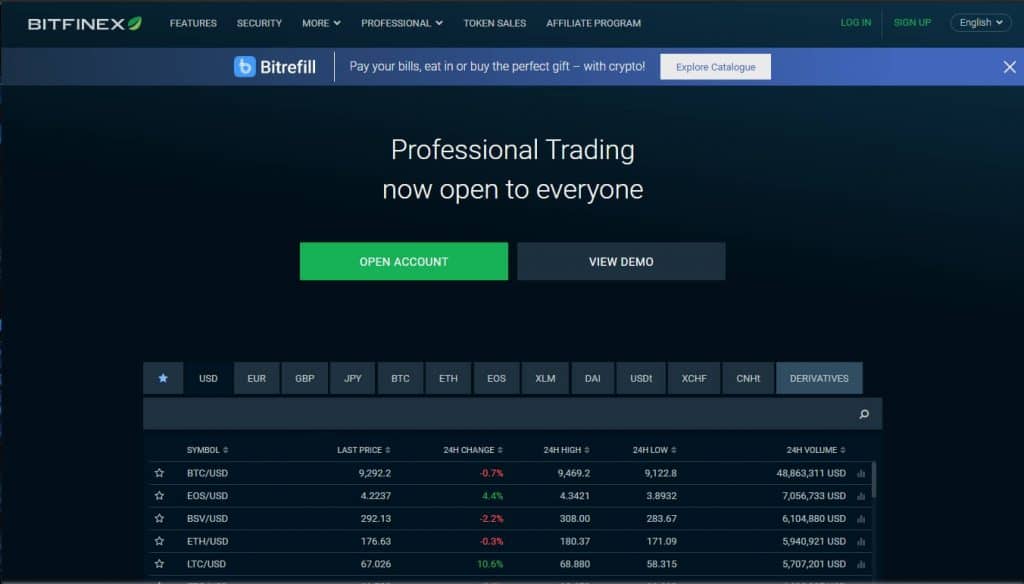

In this step-by-step guide, we will walk you through the process of trading forex on TD Ameritrade, highlighting key considerations and important steps along the way. TD Ameritrade’s forex offering includes over 70 currency pairs, covering major, minor, and exotic currencies. You can trade popular pairs like EUR/USD, GBP/USD, and USD/JPY, as well as less liquid pairs such as USD/NOK and USD/ZAR. The platform also allows you to trade forex options, providing additional flexibility in your trading strategies. Margin is the amount of money required to open and maintain a leveraged position.

In conclusion, understanding the TD Ameritrade forex requirements is vital for beginners entering the forex market. By opening a margin account, fulfilling the minimum deposit requirement, and obtaining forex trading permissions, you can start trading forex with TD Ameritrade. Utilizing their powerful platform, risk management tools, and educational resources, you can navigate the forex market with confidence. However, it is crucial to use leverage responsibly, manage your margin requirements, and continually educate yourself to mitigate risks and increase your chances of success.

TD Ameritrade is a well-known name in the brokerage world, with over 11 million clients and $1.3 trillion in assets under management. The platform offers a range of investment products, including stocks, options, futures, and forex trading. For forex traders, TD Ameritrade offers over 70 currency pairs, access to research and news, and a variety of trading platforms. In conclusion, understanding the TD Ameritrade forex requirements, including maximum leverage and margin, is vital for anyone considering forex trading with this broker.

This comprises several futures contracts that offer exposure to a wide range of markets and the possibility of leverage. ➡️ETFs – The platform offers a diverse selection of Exchange-Traded Funds (ETFs), including domestic and foreign offerings. ➡️Stocks – Overall, the broker has many equities, from global multinationals to smaller, local enterprises. Traders have access to both US and foreign markets, allowing them to diversify their investment portfolio. You will be asked to provide basic personal information such as your name, address, Social Security number, date of birth, and contact information. TD Ameritrade will ask questions about your investment experience, risk tolerance, and financial goals to build a suitable portfolio plan.